The Definitive Guide to Personal Loans copyright

The Definitive Guide to Personal Loans copyright

Blog Article

Personal Loans copyright - Questions

Table of ContentsPersonal Loans copyright for DummiesPersonal Loans copyright - TruthsEverything about Personal Loans copyrightThe 6-Second Trick For Personal Loans copyrightSome Ideas on Personal Loans copyright You Should Know

Allow's dive right into what a personal lending really is (and what it's not), the factors individuals use them, and just how you can cover those insane emergency expenditures without taking on the concern of debt. A personal lending is a round figure of money you can borrow for. well, practically anything.That doesn't consist of obtaining $1,000 from your Uncle John to assist you spend for Xmas presents or allowing your flatmate place you for a couple months' lease. You shouldn't do either of those points (for a number of reasons), yet that's technically not an individual finance. Personal fundings are made with a real economic institutionlike a financial institution, credit rating union or online loan provider.

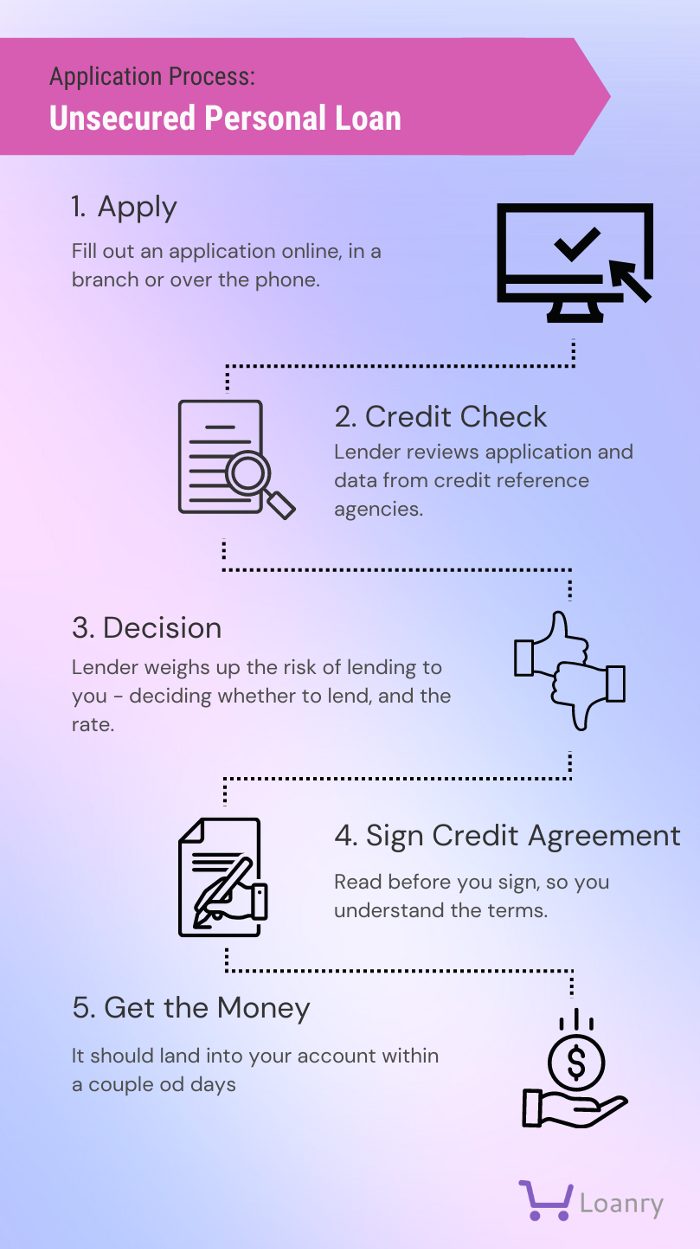

Allow's take an appearance at each so you can recognize exactly just how they workand why you don't require one. Ever. Many individual financings are unsecured, which suggests there's no collateral (something to back the car loan, like a cars and truck or residence). Unsafe car loans usually have higher rates of interest and need a much better credit rating score since there's no physical product the lending institution can remove if you do not pay up.

The 10-Minute Rule for Personal Loans copyright

Surprised? That's fine. Regardless of how great your credit scores is, you'll still have to pay passion on many personal finances. There's always a cost to spend for obtaining money. Guaranteed personal fundings, on the various other hand, have some kind of security to "secure" the funding, like a boat, precious jewelry or RVjust among others.

You might also take out a secured individual funding using your auto as collateral. Trust fund us, there's absolutely nothing secure regarding safe fundings.

Simply because the payments are predictable, it does not indicate this is an excellent deal. Personal Loans copyright. Like we stated before, you're pretty much guaranteed to pay interest on a personal financing. Simply do the mathematics: You'll wind up paying method a lot more in the lengthy run by getting a finance than if you 'd simply paid with cash

Some Known Details About Personal Loans copyright

And you're the fish holding on a line. An installation funding is a personal loan you repay in dealt with installments with time (typically once a month) till it's paid in complete - Personal Loans copyright. And don't miss this: You need to pay back the original funding quantity prior to you can borrow anything else

Don't be misinterpreted: This isn't the very same as a credit report card. With individual lines of credit score, you're paying rate of interest on the loaneven if you pay on time.

This gets us irritated up. Why? Since these businesses victimize individuals that can't pay their expenses. here And that's just incorrect. Technically, these are temporary car loans that offer you your paycheck ahead of time. That may seem confident when you remain in an economic accident and need some money to cover your costs.

Some Known Details About Personal Loans copyright

Why? Because things obtain real messy genuine quickly when you miss a payment. Those creditors will certainly follow your sweet granny who guaranteed the funding for you. Oh, and you ought to never cosign a car loan for any individual else either! Not only might you get stuck with a finance that was never indicated to be yours to begin with, however it'll mess up the partnership before you can claim "compensate." Trust us, you do not intend to get on either side of this sticky situation.

All you're truly doing is making use of brand-new financial look these up debt to pay off old debt (and extending your finance term). That just indicates you'll be paying a lot more with time. Firms understand that toowhich is exactly why so many of them provide you combination loans. A lower rates of interest doesn't get you out of debtyou do.

And it starts with not borrowing anymore cash. ever. This is a good guideline Full Report for any type of economic acquisition. Whether you're believing of getting an individual finance to cover that kitchen remodel or your frustrating credit rating card costs. don't. Getting financial obligation to spend for things isn't the method to go.

Our Personal Loans copyright PDFs

The very best point you can do for your economic future is leave that buy-now-pay-later mindset and say no to those spending impulses. And if you're considering an individual lending to cover an emergency situation, we get it. Borrowing cash to pay for an emergency only escalates the stress and difficulty of the situation.

Report this page